If you're expecting to read about a lot of psychology research, you'll be disappointed; this book is largely driven by anecdotes and some economic data. It also probably won't contain any startlingly new information if you've read much on personal finance before. But it is a concise, punchy presentation of several principles that are worth being reminded of from time to time.

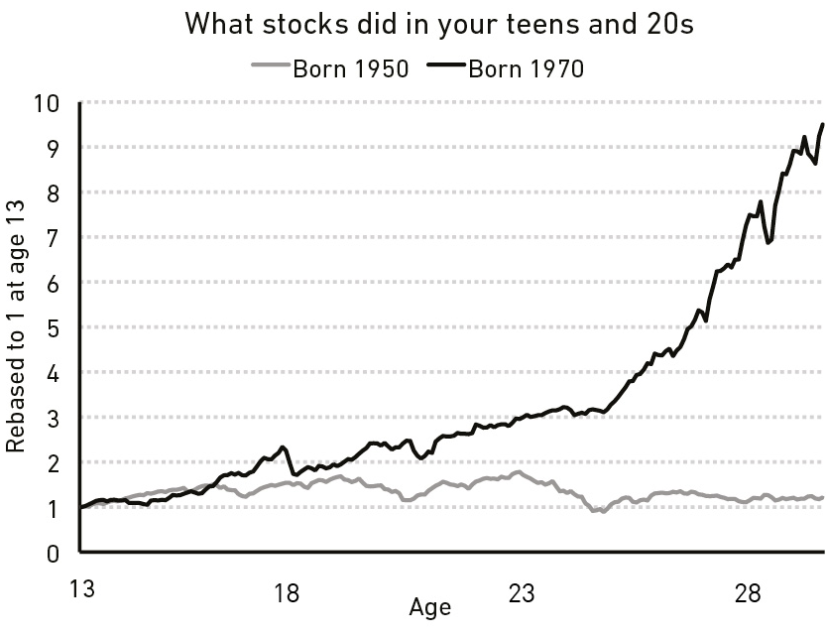

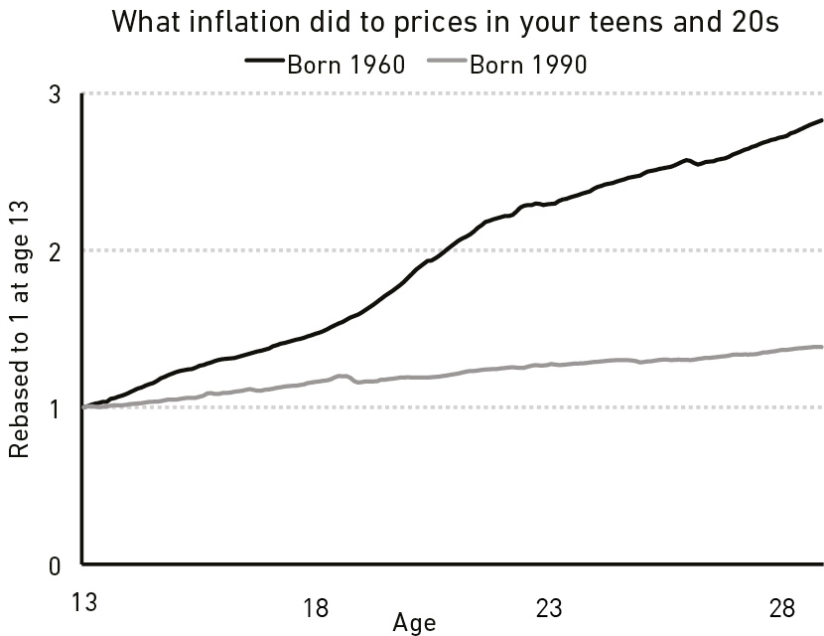

Perspective. One principle is to be aware how much your worldview is influenced by your own idiosyncratic experiences. Housel provides these two graphs to highlight how radically your impressions of the stock market and the risk of inflation are likely to differ based on when you were born:

The same chapter talks about how so many aspects of our financial lives are very recent developments. For example, "the entire concept of being entitled to retirement is, at most, two generations old" and index funds "are less than 50 years old."

Luck. Another principle is that it's very difficult to tell how much an outcome - good or bad - is the result of luck. This has practical implications about where we should look for guidance:

Studying a specific person can be dangerous because we tend to study extreme examples—the billionaires, the CEOs, or the massive failures that dominate the news—and extreme examples are often the least applicable to other situations, given their complexity. The more extreme the outcome, the less likely you can apply its lessons to your own life, because the more likely the outcome was influenced by extreme ends of luck or risk.

Contentment. Housel quotes the following from John Bogle:

At a party given by a billionaire on Shelter Island, Kurt Vonnegut informs his pal, Joseph Heller, that their host, a hedge fund manager, had made more money in a single day than Heller had earned from his wildly popular novel Catch-22 over its whole history. Heller responds, "Yes, but I have something he will never have ... enough."

It's cliche but crucial. Lifestyle inflation and continually comparing ourselves to others can create an endless treadmill where we think we need more and more money but the happiness the money was supposed to buy us is forever out of reach.

Survival. I love Housel's recommendation to be "optimistic about the future, but paranoid about what will prevent you from getting to the future". Staying in the game is more important than playing the game optimally. This comes up in a few different ways throughout the book: having the best investing strategy is a lower priority than just making sure you keep investing (and staying invested) over time; you should put effort into making it very hard for anything to ruin you, not just into trying to get the best returns; you should make career choices that won't burn you out...

Personal change. Housel notes that what you want today tends to be different from what you wanted years ago and what you'll want years from now. He gives some insightful advice based on this:

We should avoid the extreme ends of financial planning. Assuming you'll be happy with a very low income, or choosing to work endless hours in pursuit of a high one, increases the odds that you'll one day find yourself at a point of regret. The fuel of the End of History Illusion is that people adapt to most circumstances, so the benefits of an extreme plan—the simplicity of having hardly anything, or the thrill of having almost everything—wear off. But the downsides of those extremes—not being able to afford retirement, or looking back at a life spent devoted to chasing dollars—become enduring regrets. Regrets are especially painful when you abandon a previous plan and feel like you have to run in the other direction twice as fast to make up for lost time. [emphasis removed]

Volatility. Some people are reluctant to invest because it is very difficult for them to handle the inevitable periods of decline. Housel suggests they're thinking of volatility as "a fine for doing something wrong" and need to instead see it "as a fee":

Market returns are never free and never will be. They demand you pay a price, like any other product. You're not forced to pay this fee, just like you're not forced to go to Disneyland. You can go to the local county fair where tickets might be $10, or stay home for free. You might still have a good time. But you'll usually get what you pay for. Same with markets. The volatility/uncertainty fee—the price of returns—is the cost of admission to get returns greater than low-fee parks like cash and bonds.